The Evolution of CETES

The Mexican bond market has evolved significantly since its inception in 1978, marked by the introduction of government-issued Treasury Certificates (CETES).

Here, we explore the historical development of Mexico’s Bond Market and introduce a tokenized CETES called Stablebonds.

The Tequila Crisis

Mexico’s government debt market was introduced to strengthen financing for government operations, offering a dependable investment avenue that has significantly influenced Mexico’s economic policies. CETES were built to provide secure, short-term investment options for domestic and international investors, ensuring government liquidity and financial stability.

However, in the mid-1990s, Mexico experienced a severe economic downturn called the Tequila Crisis. This crisis derived its name from the sudden devaluation of the Mexican Peso, which had significant repercussions across Latin and South America.

This downturn was caused by Mexico’s heavy reliance on foreign-currency-denominated securities, specifically its peg of the Peso to the US Dollar. Mexico’s central bank issued debt denominated in dollars to stabilize the peso, exacerbating the country's debt burden when measured in USD, which ultimately had significant and widespread consequences.

With increasing use of stablecoins, which are primarily denominated in USD, Mexico faces the risk of once again becoming overly dependent on the US dollar. The evolution of CETES and the creation of a tokenized version of Stablebonds serves to mitigate this risk and remain consistent with the original objective of CETES bonds.

Reformation and Growth

To address the economic downturn, Mexico pushed reforms to decrease reliance on external capital and stabilize its financial system internally. These enhancements in economic policy have strengthened the domestic market, enhancing liquidity and attracting increased investor engagement. These structural changes include:

Fiscal reform: aims to lessen dependence on export revenues by introducing consumption taxes and closing tax loopholes.

Financial reform: enhances access to credit for households and small businesses by lowering costs and expanding commercial bank development.

Economic competition reform: establishes and strengthens market oversight agencies to foster credibility and competitiveness in Mexico’s concentrated industries.

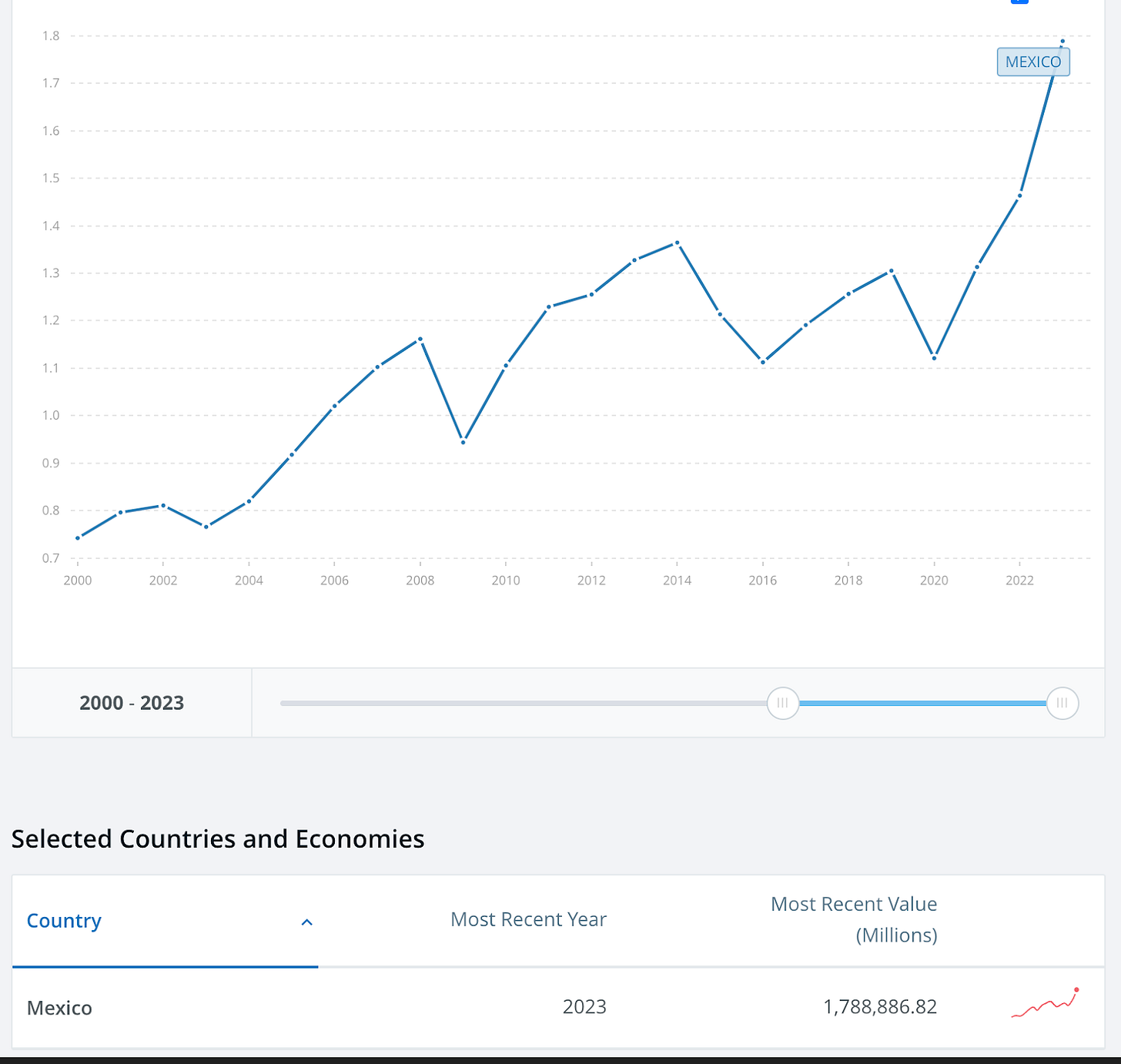

Today, Mexico stands out as one of Latin America’s leading nations in terms of economic growth and the development of financial markets. With the advancement of the Mexican economy, sovereign debt securities have seen a significant increase, reaching 873.5 billion USD.

What are CETES?

CETES, officially known as Certificados de la Tesorería de la Federación, are Mexico’s oldest short-term debt securities issued by the Ministry of Finance. They play crucial roles in the financial system, serving purposes such as government financing, influencing monetary policy, and providing a safe investment option.

CETES are BBB+-rated short-term government bonds and are highly liquid in the Mexican market. Interest on these bonds accrues until maturity, and their rates are determined through government auctions, which ensures the backing of the Mexican government.

The outstanding amount of CETES is approximately 1,832.4 billion MXN or 109 billion USD, with a yield exceeding 10%. As of June 2024, the Banco de México has decided to maintain the interest rate at 11% until the end of 2025.

Stablecoins

In the past six months, the market cap of stablecoins has surged from $122 billion in October 2023 to $157 billion by April 2024. Many of these stablecoins are pegged specifically to the US Dollar. As blockchain technology expands, there is a growing demand for stablecoins pegged to local currencies.

Since 2016, the stablecoin network has experienced significant growth, with increasing supply and a growing number of active users, and is now effectively a tradeable currency. Stablecoins are emerging as a simple and convenient method for international money transfers.

Given that a substantial portion of Mexico’s economy relies on incoming remittances, with over 96% originating from the US in 2023, these trends reinforce foreign currency dependence despite efforts to reduce it.

CETES Stablebonds

Etherfuse has introduced the CETES Stablebond, a tokenized Mexican treasury, denominated in the local currency. This allows Mexico to benefit from the blockchain’s growth while reducing reliance on foreign currency, utilizing blockchain technology alongside traditional sovereign bonds. This initiative realigns with the initial goal of CETES, diminishing external capital dependence.

These Stablebonds are a modern iteration of Mexico’s CETES bonds, designed to optimize returns and investor experience through:

Single Minting Process: Unlike traditional bonds, CETES Stablebonds simplify the investment process with a single mint. This eliminates the need to return for multiple reinvestments, enhancing investor management.

Weekly Rebase Mechanism: Investors benefit from the CETES Annual Percentage Yield (APY), which adjusts weekly based on market conditions. This feature ensures that Stablebonds remain competitive and responsive to economic fluctuations.

Accessibility and Security: CETES Stablebonds are structured to cater to seasoned investors and newcomers to the bond and blockchain markets. Backed by government bonds, they provide a robust layer of security, assuring reliability and profitability on investments.

Conclusion

Mexico’s bond market has evolved significantly since introducing debt securities in 1978, enhancing their economic growth and fostering a stable investment environment. The evolution of Mexico’s economy is a testament to its resilience and adaptability. Today, Mexico is a leading economic force in Latin America, marked by significant growth and strengthening financial markets.

The introduction of CETES Stablebonds represents a forward-thinking approach to modernizing traditional sovereign bonds. By integrating blockchain technology, CETES Stablebonds streamline the investment process, enhance security, and improve accessibility.

Stablebonds are an evolution of CETES, designed to empower Mexico to maintain control over its financial future and fulfill CETES's original purpose. This shift from foreign-currency-backed coins to stablecoins backed by CETES aims to enhance local value capture and reinvestment in communities.