Dangers of Digital Dollarization

How can emerging markets navigate digital currencies while maintaining monetary sovereignty?

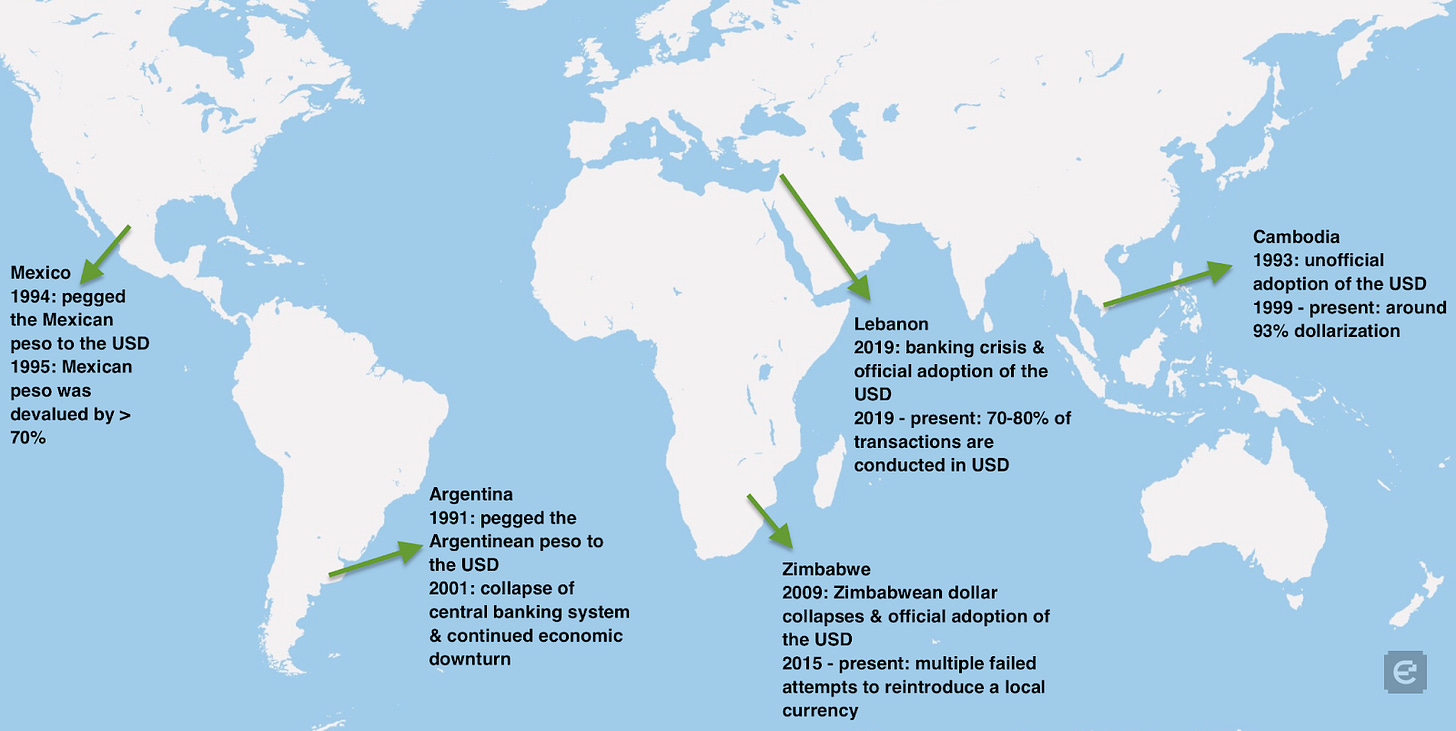

Historical Dollarization

The Theory of Dollarization refers to the process by which a country adopts a foreign currency, often the US dollar, as an exchange instrument, inflation hedge, or store of value. This plays out in two ways: official dollarization occurs when a governing body formally replaces its domestic currency with the dollar, as we have seen in Ecuador and El Salvador, or unofficial dollarization, which happens on a local level when citizens choose to spend and save in US dollars.

In times of instability or devaluation, it is logical to seek a safer and more stable currency, but history has shown that reliance on foreign funds is a double-edged sword. While offering protection against inflation and improvement in economic stability, dollarization dismantles economic sovereignty by restricting a country’s ability to operate an independent monetary policy.

Stablecoins in Emerging Markets

Reliance on US dollar-backed assets is nothing new in emerging markets. Historically, in times of financial instability, governments navigated these challenges by holding USD (cash), foreign high-yield bonds, currency pegs, or imposing capital controls. Persistent market volatility means that people will continue to use the currency they deem secure, now in the form of stablecoins.

The Problem: USD Stablecoins

Undermining Monetary Sovereignty

The current stablecoin model is the digitized evolution of the dollarization dilemma, and emerging market participants are turning to fiat-backed stablecoins (99% of which are denominated in USD) for the same reasons they historically relied on USD fiat. Shifting savings, transactions, and investments into USD stablecoins weakens the local financial system, further restricting the government’s tools to manage their economies.

I. Loss of Monetary Policy: Monetary policy is the most powerful tool to stabilize inflation and boost economic growth, but stablecoins weaken its impact. When transactions are primarily exchanged in a foreign currency, inflation is more challenging to control, banks lose deposits, and interest rates are less effective.

II. Capital Flight: Mass USD stablecoin adoption means large monetary outflows, which can drain the local economy. If too many individuals park their funds in foreign assets, it could result in a liquidity crisis. Money leaving a domestic market shirks currency deposits, resulting in banks having less money to lend. This leads central banks to burn through their reserves.

III. Dependence on the US: When an individual purchases a USD-pegged coin, the issuer (Tether, Circle, etc.) invests those funds into US treasuries. Upon maturity, the yield on those treasuries benefits the issuing institution and the US government, rather than the local country in which the stablecoin is used. All US assets, on or off-chain are subject to Federal Reserve regulations, regardless if those policies don’t align with domestic market needs.

So, why can’t smaller nations issue their own stablecoin?

Although these coins are widespread, the idea of tokenizing real-world currencies and assets is relatively new. As development and regulatory frameworks are being built, people will rely on what they know is stable. Tokenizing a weak currency does not resolve the underlying financial issues and will remain uncompetitive against the dollar.

Solution: Yield-Bearing Stablecoins

Traditional stablecoins are pegged 1:1 with their underlying fiat reserve, whereas yield-bearing tokens are backed by sovereign bonds and return interest to the token holder.

Unlike other stablecoins, which do not return yield to the holder, sovereign bonds provide the same level of security and are underlined by sovereign bonds.

How Do Soverign Yield Coins Work?

Sovereign nations can issue their own yield-bearing stable coin backed with short-term government bonds and tied to local currency. Yield from the underlying bond accumulates to the token’s holder rather than the issuer. The only way to compete with foreign digital currencies is to create one that incentivizes people to hold it, offering stability and financial returns. Regardless of price or allegiance to a country, people aren’t willing to hold a depreciating asset when a more stable and accessible alternative exists.

Over the past 20 years, the Mexican peso has lost value against the dollar, but an individual investing in CETES during that period would have outpaced the dollar’s return by 3.30%. This means a yield-bearing CETES-backed stablecoin could retain its value while keeping wealth within the Mexican economy, despite currency fluctuations. The same trend is evident in other emerging markets like Brazil and Turkey, highlighting the potential for stronger stablecoins that reward individuals for holding their local currency rather than penalizing them through inflation.

Dedollarize

Two things are clear: we are moving towards digitalized currencies, and economies cannot survive if relying on a foreign currency. While stablecoins have clear benefits, the current model disproportionately favors the US. The only viable way for emerging markets to stop digital dollarization is by issuing sovereign-backed, yield-bearing stablecoins. If smaller nations create digital assets that stimulate local economies and reward holds. In that case, people are incentivized to keep their funds in the local market, reducing capital flight and allowing governments to maintain their monetary sovereignty.